Our Guide To The Age Pension

Did you know the Age Pension is payable until one’s death and adjusts for inflation over time - meaning that your pension will continue to increase throughout your retirement years?

This is really important as Australians have the 4th longest life expectancy in the world meaning that you’ll have many years to enjoy retirement and will need lots of retirement income along the way.

Calculating how much you need (and how to maximise your entitlements) can be quite complicated. Rather than leaving things to chance, partnering with a financial adviser to discuss the probability of meeting your retirement income needs is key.

Barwon Financial Planning’s Guide To The Age Pension

Age Pension Eligibility

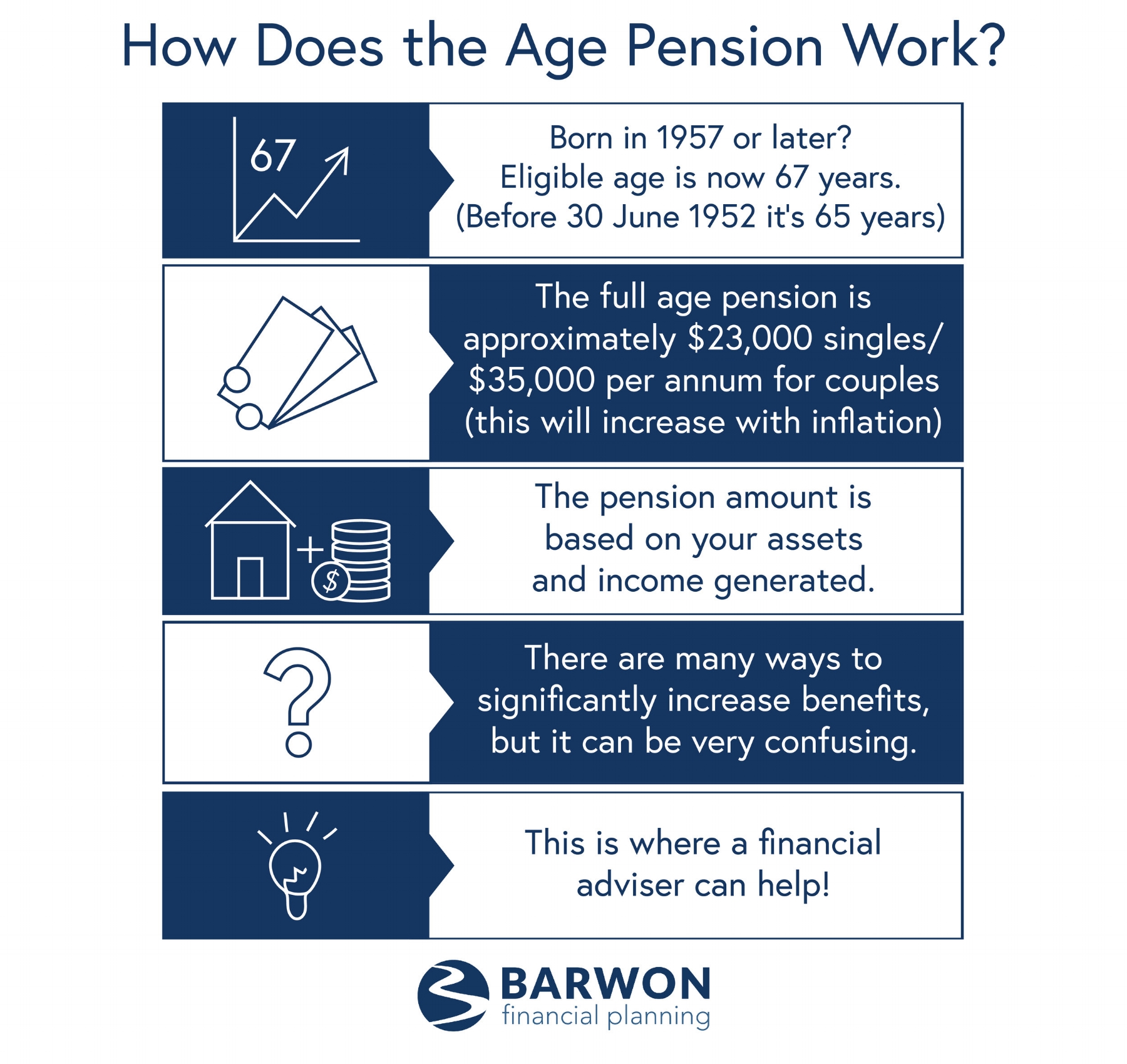

To be eligible for the Age Pension, the minimum commencement age is gradually increasing from age 65 to 67 years of age for those born in 1957 or later.

The full Age Pension is over $23,000/$35,000 per annum for a single person/couple respectively.

The amount of pension received is based on the amount of assets accumulated over your life and income generated.

There are many ways to significantly increase age pension entitlements throughout retirement, but it can be very confusing.

Maximising ones pension entitlements should be a priority and partnering with a financial adviser can help to clarify the age pension rules, maximise benefits and assist with understanding how much you can expect to receive.